“Master Market Moves: Harness Fibonacci Retracement for Strategic Forex & Crypto Trades”

Mastering Fibonacci Retracement: A Guide to Enhancing Technical Analysis in Forex Trading

Fibonacci Retracement Levels: Applying Technical Analysis in Forex and Crypto Trading

In the realm of financial trading, technical analysis stands as a cornerstone for strategizing and forecasting market movements. Among the myriad of tools available to traders, Fibonacci retracement levels have garnered widespread acclaim for their ability to predict potential support and resistance levels with an uncanny precision. This mathematical wonder, derived from the Fibonacci sequence, has proven to be an invaluable asset in the arsenal of Forex and cryptocurrency traders alike.

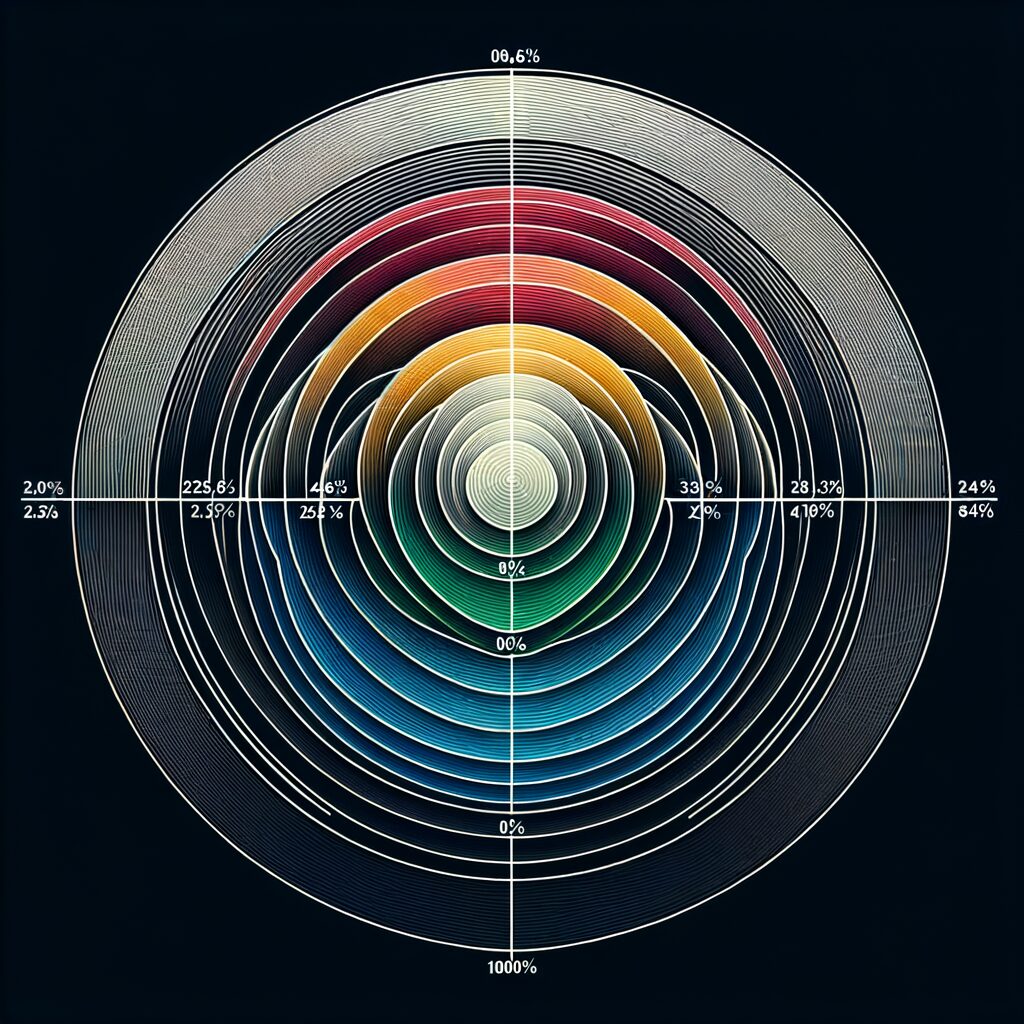

The Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones, starts with 0 and 1, and progresses indefinitely. The sequence itself is not what's used in trading, but rather the ratios that are derived from these numbers, which are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These percentages are what traders refer to as Fibonacci retracement levels. They are used to identify potential reversal points in the market by drawing a line between a significant high and low point on a chart, and then applying these percentages to that range.

The application of Fibonacci retracement in Forex trading is particularly compelling due to the high liquidity and the round-the-clock nature of the market. Forex traders meticulously analyze currency pair price charts to identify trends and the possible points where the market may pause or reverse. By overlaying Fibonacci levels onto a price chart during a strong trend, traders can anticipate areas where the market may retrace before continuing in the direction of the original trend. This allows for strategic entry and exit points, optimizing the potential for profit while minimizing risk.

Similarly, in the volatile world of cryptocurrency trading, Fibonacci retracement levels serve as a beacon of predictability amidst the tumultuous price swings. Crypto traders, much like their Forex counterparts, utilize these levels to gauge entry and exit points. Given the nascent and highly speculative nature of cryptocurrencies, these tools are indispensable for traders seeking to navigate the digital asset markets with a measure of analytical rigor.

It is important to note, however, that Fibonacci retracement levels are not foolproof indicators. They are best used in conjunction with other technical analysis tools and indicators, such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence). By corroborating the signals from multiple sources, traders can increase their confidence in the potential price movements suggested by the Fibonacci levels.

Moreover, the psychological aspect of trading cannot be overstated. Fibonacci levels often become self-fulfilling prophecies as a large number of traders pay heed to these levels, thus influencing market behavior. The collective anticipation of a retracement or reversal at certain Fibonacci levels can lead to increased buying or selling pressure at those points, which in turn can cause the predicted price movement to manifest.

In conclusion, Fibonacci retracement levels are a potent tool for traders who wish to refine their technical analysis in both Forex and cryptocurrency markets. By providing a structured approach to identifying potential support and resistance levels, these ratios help traders make more informed decisions. However, it is crucial for traders to remember that no single tool should be used in isolation. A comprehensive trading strategy that incorporates multiple technical indicators, along with a keen understanding of market psychology, will always be the most effective approach to navigating the complex and ever-changing landscape of financial markets.

The Role of Fibonacci Retracement Levels in Crafting Effective Trading Signals

Fibonacci Retracement Levels: Applying Technical Analysis in Forex and Crypto Trading

In the realm of financial trading, technical analysis stands as a cornerstone for traders aiming to predict future market movements and craft effective trading strategies. Among the myriad of tools available, Fibonacci retracement levels have garnered widespread acclaim for their ability to provide insight into potential support and resistance levels. These levels, derived from the Fibonacci sequence, are not only applicable in the forex market but have also found their place in the volatile world of cryptocurrency trading.

The Fibonacci sequence, a series of numbers where each subsequent number is the sum of the two preceding ones, begins with 0 and 1, and continues indefinitely. The sequence itself has fascinated mathematicians for centuries, but its application in financial markets is a relatively modern development. The key Fibonacci retracement levels—23.6%, 38.2%, 50%, 61.8%, and 78.6%—are obtained by dividing numbers in the sequence to find ratios that are then used to forecast the extent of a correction or a reversal after a market trend.

Traders employ these levels by drawing horizontal lines on a price chart at the percentages mentioned above, between a high and low point. The premise is that after a significant price movement, either up or down, the market will often retrace or reverse by a proportion of that movement before continuing in the original direction. These retracement levels serve as potential areas where the price might pause or reverse, providing traders with opportunities to enter or exit the market.

In forex trading, where currency pairs fluctuate continuously, Fibonacci retracement levels offer a method to gauge the pulse of the market. For instance, if a currency pair experiences a substantial uptrend, traders might anticipate a retracement at one of the Fibonacci levels. Conversely, in a downtrend, these levels can indicate where a recovery might begin to falter, and the downtrend resume. The predictive power of these levels, while not infallible, is enhanced when combined with other indicators and analysis techniques, such as moving averages or trend lines.

Similarly, in the cryptocurrency market, characterized by its high volatility and speculative nature, Fibonacci retracement levels provide a semblance of order amidst the chaos. Crypto traders, grappling with rapid price swings, often turn to these levels to make sense of market movements. The psychological aspect of trading plays a significant role here, as many traders place buy or sell orders around these levels, thereby reinforcing their significance.

Moreover, the self-fulfilling prophecy aspect of Fibonacci levels cannot be overlooked. Since a large number of traders pay attention to these levels, their collective actions can lead to the anticipated market behavior at these points, thereby validating the tool's effectiveness. However, it is crucial for traders to remember that no technical analysis tool can guarantee results, and the use of Fibonacci retracement levels should be part of a comprehensive trading plan that includes risk management strategies.

In conclusion, Fibonacci retracement levels are a vital component in the toolkit of many traders, providing valuable insights into potential turning points in both forex and cryptocurrency markets. By applying these levels in conjunction with other technical analysis methods, traders can enhance their ability to generate effective trading signals. As with all trading tools, the key to success lies in understanding their limitations and using them judiciously within the broader context of market conditions and individual trading goals.

Integrating Fibonacci Tools for Predicting Price Levels in Crypto Trading Strategies

Fibonacci Retracement Levels: Applying Technical Analysis in Forex and Crypto Trading

In the realm of financial trading, technical analysis stands as a cornerstone for strategizing and forecasting market movements. Among the myriad of tools available to traders, Fibonacci retracement levels have gained prominence for their ability to predict potential support and resistance levels. This mathematical concept, derived from the Fibonacci sequence, is not only applicable in the forex market but has also found its place in the volatile world of cryptocurrency trading.

The Fibonacci sequence, a series of numbers where each subsequent number is the sum of the two preceding ones, starts with 0 and 1, and continues indefinitely. The sequence itself is not what traders are interested in; rather, it is the ratios derived from these numbers that are key. The primary ratios used in trading are 23.6%, 38.2%, 61.8%, and sometimes 78.6%. These percentages are considered to be significant levels where price could potentially reverse or stall, making them invaluable for traders looking to enter or exit the market.

When applying Fibonacci retracement levels to a chart, a trader selects two significant points, usually a high and a low. The tool then creates horizontal lines at the percentages mentioned above, indicating where support and resistance are likely to occur. In forex trading, these levels are used to gauge where currency pairs might retrace before continuing in the direction of the original trend. Similarly, in the crypto market, with its notorious price swings, these levels provide a semblance of order in what can often seem like chaotic price movements.

Integrating Fibonacci tools into a trading strategy requires an understanding of market trends. In a bullish market, traders will look for retracement levels during pullbacks to identify potential entry points, anticipating that the price will resume its upward trajectory. Conversely, in a bearish market, retracement levels can signal where a corrective rally might falter, offering opportunities to short-sell or exit long positions.

Moreover, the effectiveness of Fibonacci retracement levels is often enhanced when combined with other technical indicators. For instance, if a retracement level coincides with a moving average or a key historical support/resistance level, it may provide a stronger signal that the price is likely to react at this point. This confluence of indicators can increase the confidence of traders in their decision-making process.

It is important to note, however, that like all technical analysis tools, Fibonacci retracements are not foolproof. They are based on the premise that markets move in predictable patterns, but external factors such as economic news, regulatory announcements, or even market sentiment can disrupt these patterns. Therefore, traders should use Fibonacci levels as a guide rather than a definitive predictor of price movements.

In the context of cryptocurrency trading, where the markets are relatively young and can be driven by speculative fervor, Fibonacci retracement levels offer a way to bring a measure of technical discipline to trading strategies. They help traders navigate the ebbs and flows of digital asset prices, providing potential areas of interest for trade execution.

In conclusion, Fibonacci retracement levels are a powerful tool in the arsenal of technical traders, applicable across various asset classes including forex and cryptocurrencies. By identifying potential reversal points, they aid in the formulation of entry and exit strategies. However, traders must remember to use them in conjunction with other analysis methods and remain aware of the broader market context to maximize their effectiveness. As with any trading tool, practice and experience will refine the use of Fibonacci retracements, making them an integral part of a trader's approach to the markets.

Advanced Techniques for Using Fibonacci Retracement in Forex and Crypto Market Analysis

Fibonacci Retracement Levels: Applying Technical Analysis in Forex and Crypto Trading

In the realm of financial trading, technical analysis stands as a cornerstone for strategizing and forecasting market movements. Among the myriad of tools available to traders, Fibonacci retracement levels are revered for their ability to pinpoint potential support and resistance levels. These levels are derived from the Fibonacci sequence, a series of numbers where each subsequent number is the sum of the two preceding ones. The application of these levels in Forex and crypto trading has gained substantial traction, offering a blend of mathematical harmony and market psychology.

The Fibonacci retracement tool is primarily used to identify the extent to which a market will move against its current trend. By drawing horizontal lines at the key Fibonacci ratios of 23.6%, 38.2%, 50%, 61.8%, and sometimes 76.4%, traders can anticipate where prices might pause or reverse. These ratios are not only rooted in the natural order of the universe but also seem to reflect the collective behavior of market participants.

To apply Fibonacci retracement levels effectively, one must first identify significant price points, typically a high and a low. From these points, the tool is applied, stretching across the chart to provide a visual representation of potential retracement levels. It is crucial to note that these levels are not guarantees of price action but rather areas where traders should be vigilant for signs of price reaction.

Moreover, the confluence of signals can enhance the reliability of Fibonacci retracement levels. For instance, if a retracement level aligns with a long-term moving average or a key historical support or resistance level, the combined evidence may suggest a stronger likelihood of price interaction. Additionally, incorporating other technical indicators such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) can provide further confirmation of a potential reversal.

In the volatile landscape of Forex and crypto markets, Fibonacci retracement levels offer a semblance of order amidst the chaos. The Forex market, with its high liquidity and 24-hour trading cycle, presents numerous opportunities for applying Fibonacci analysis. Similarly, the burgeoning crypto market, despite its relative infancy, has shown a propensity to adhere to these technical levels, perhaps due to the technical-savvy nature of its participants.

It is imperative for traders to remember that the effectiveness of Fibonacci retracement levels can be influenced by market conditions. During strong trends, retracements may be shallower, with prices finding support or resistance closer to the 23.6% or 38.2% levels. Conversely, during more corrective phases, deeper retracements to the 61.8% level or beyond are not uncommon. This dynamic nature of markets necessitates a flexible approach to the use of Fibonacci levels.

Furthermore, the psychological aspect of trading cannot be overstated. Fibonacci levels often work because traders expect them to work, creating a self-fulfilling prophecy as a multitude of market participants place orders at these points. This collective anticipation can sometimes turn these technical projections into tangible pivot points in price action.

In conclusion, Fibonacci retracement levels are a powerful tool in the arsenal of Forex and crypto traders. When applied with precision and in conjunction with other technical analysis methods, they can provide valuable insights into potential turning points in the markets. However, traders must wield this tool with an understanding of its limitations and a keen awareness of the psychological and market forces at play. As with any advanced technique, proficiency comes with experience and a deep appreciation for the subtle interplay between numbers and human behavior in the financial markets.