“Master the Market: Harness Emotions, Trade with Precision.”

Mastering Mental Preparation: Techniques for Emotional Control in Trading

Trading Psychology: How to Control Emotions During Trades

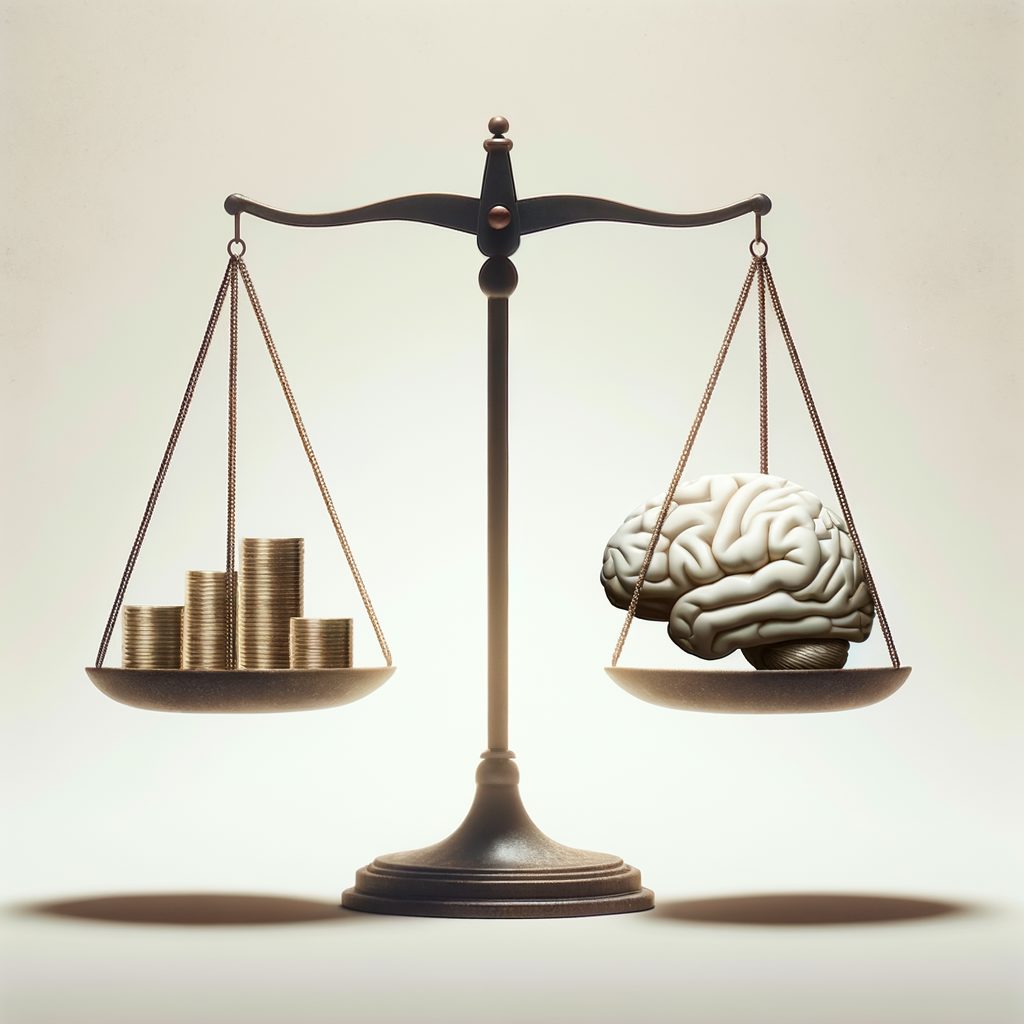

In the world of trading, where markets fluctuate with relentless unpredictability, the ability to maintain emotional equilibrium is as valuable as a keen analytical mind. Mastering mental preparation and developing techniques for emotional control are not just beneficial; they are essential for success in trading. The volatile nature of trading can evoke a spectrum of emotions, from the euphoria of a winning streak to the despair of a sudden loss. However, it is the trader who can navigate these emotional tides that often emerges victorious.

The first step in controlling emotions during trades is to acknowledge their presence. Denying or suppressing feelings can lead to impulsive decisions, as emotions will eventually surface, often at inopportune moments. Instead, traders should aim to recognize their emotional responses and understand the triggers that set them off. This self-awareness creates a foundation upon which strategies for emotional regulation can be built.

One effective technique for managing emotions is to establish a trading plan and adhere to it strictly. A well-thought-out plan includes entry and exit strategies, risk management rules, and profit targets. By committing to this plan, traders can reduce the emotional impact of market movements, as decisions are based on predefined criteria rather than the heat of the moment. This approach also helps in maintaining discipline, a trait that is indispensable in the face of market adversity.

Another critical aspect of emotional control is setting realistic expectations. The allure of quick profits can cloud judgment, leading to overconfidence or undue risk-taking. Traders must understand that losses are part of the game and that success is measured over the long term. By setting achievable goals and accepting the inherent risks of trading, individuals can temper their emotional responses to wins and losses alike.

Risk management is a further cornerstone of emotional control. By only risking a small percentage of the trading capital on any single trade, traders can ensure that no single loss is catastrophic. This not only preserves the financial capital but also the emotional capital, as traders are less likely to experience the extreme stress that comes with the potential of a devastating loss.

Mindfulness and meditation have also gained popularity among traders as tools for emotional regulation. These practices encourage a state of present-moment awareness, which can help traders remain focused and calm, regardless of market conditions. By cultivating mindfulness, traders can better observe their thoughts and emotions without becoming entangled in them, allowing for more rational decision-making.

Finally, it is crucial to take regular breaks from trading to prevent burnout and maintain perspective. Continuous exposure to market stress can lead to emotional fatigue, making it harder to stay disciplined and focused. Periodic breaks allow traders to recharge and return to the markets with a clear mind and renewed energy.

In conclusion, emotional control in trading is not about eliminating emotions but managing them effectively. By acknowledging emotions, sticking to a trading plan, setting realistic expectations, practicing risk management, utilizing mindfulness techniques, and taking regular breaks, traders can fortify their mental preparedness. The journey to becoming a master of the markets is as much about cultivating emotional resilience as it is about developing technical expertise. Those who invest in their psychological fortitude are likely to find that their trading performance benefits as a direct result.

The Psychology of Trading Success: Managing Emotions and Stress for Optimal Performance

Trading Psychology: How to Control Emotions During Trades

In the realm of financial markets, the importance of trading psychology cannot be overstated. The ability to manage emotions and stress is often what separates the successful traders from those who struggle to maintain profitability. Emotional control is the cornerstone of trading discipline, and without it, even the most sophisticated strategies can falter. Understanding and managing the psychological aspects of trading is essential for optimal performance.

The volatility of markets can trigger a rollercoaster of emotions, from the euphoria of a winning trade to the despair of a sudden loss. These emotional responses, if not checked, can lead to impulsive decisions, such as chasing losses or deviating from a well-thought-out trading plan. To control these emotions, traders must first acknowledge their presence. Self-awareness is the first step in emotional regulation, as it allows traders to recognize their emotional triggers and patterns of behavior.

Once traders are aware of their emotional responses, they can begin to implement strategies to mitigate their impact. One effective method is to establish a routine that includes pre-trade preparation and post-trade analysis. By doing so, traders can approach the market with a clear and focused mindset, reducing the likelihood of emotional decision-making. Preparation involves reviewing market conditions, economic news, and technical indicators, while analysis after trades helps in understanding what went right or wrong, further refining trading strategies.

Another crucial aspect of trading psychology is setting realistic expectations. The allure of quick profits can often lead traders to take on excessive risk or to expect too much from a trade. By setting achievable goals and understanding the probabilistic nature of trading, traders can maintain a balanced perspective, which helps in keeping emotions such as greed and fear at bay.

Risk management is also a vital component of emotional control. By determining the amount of capital to risk on each trade and sticking to it, traders can limit their emotional exposure. This approach helps in maintaining composure even when a trade does not go as planned. A well-defined risk management strategy includes setting stop-loss orders to cap potential losses and taking profits at predetermined levels to protect gains.

Mindfulness and stress reduction techniques can further aid traders in managing their emotions. Practices such as meditation, deep breathing exercises, or even engaging in physical activity can help in calming the mind and reducing stress. A calm mind is better equipped to handle the uncertainties of trading and can make more rational decisions.

Moreover, it is important for traders to maintain a healthy work-life balance. Obsessing over the markets without taking breaks can lead to burnout and increased emotional sensitivity. By stepping away from the trading desk and engaging in other activities, traders can return to the markets with a refreshed perspective and improved mental clarity.

In conclusion, the psychology of trading is a critical factor in achieving success in the financial markets. Controlling emotions during trades requires self-awareness, preparation, realistic expectations, risk management, mindfulness, and a balanced lifestyle. By mastering these psychological aspects, traders can navigate the markets with greater confidence and discipline, leading to improved decision-making and better overall performance. Remember, in the world of trading, it is not just the strength of the strategy that matters, but also the mental fortitude to execute it effectively.

Emotional Management for Traders: Strategies to Stay in Control During Trades

Trading Psychology: How to Control Emotions During Trades

In the world of trading, the importance of strategy, knowledge, and technical analysis is often emphasized. However, the role of trading psychology and emotional management is equally critical to success. The ability to control emotions during trades can be the difference between a successful trader and one who struggles to maintain profitability. Emotional management for traders involves a set of strategies designed to help individuals stay in control during the heat of the market.

One of the first steps in mastering trading psychology is to recognize the emotions that are most likely to influence decision-making. Fear and greed are two of the most powerful emotions that traders must contend with. Fear can lead to panic selling at the worst possible time, while greed can cause traders to hold onto positions for too long, hoping for an even greater profit, only to see their gains disappear. Recognizing these emotions as they arise is crucial, as it allows traders to take a step back and assess the situation more objectively.

Once traders are aware of their emotional triggers, they can begin to develop strategies to mitigate their impact. One effective method is to establish a trading plan and stick to it. A well-thought-out trading plan includes entry and exit points, stop-loss orders, and a clear understanding of one's risk tolerance. By adhering to this plan, traders can reduce the temptation to make impulsive decisions based on short-term market movements.

Another key aspect of emotional management is to maintain a level of detachment from the trades. This does not mean that traders should be disinterested in the outcome of their trades, but rather that they should not become emotionally invested in any single position. By maintaining a professional distance, traders can more easily accept losses as part of the trading process and move on without becoming discouraged.

It is also beneficial for traders to keep a journal of their trades, including the emotional state they were in when they made each trade. This practice can provide valuable insights into patterns of emotional response and decision-making. Over time, traders can learn from their experiences and begin to identify situations that may lead to emotional trading, allowing them to take preemptive steps to avoid these pitfalls.

Moreover, setting realistic expectations is vital for emotional control. The market is unpredictable, and even the most seasoned traders will experience losses. By understanding that setbacks are a natural part of trading, individuals can temper their emotional reactions and focus on the long-term goals rather than being swayed by short-term fluctuations.

Finally, self-care should not be overlooked in the realm of trading psychology. Stress can exacerbate emotional responses, so it is important for traders to ensure they are taking care of their physical and mental health. This includes getting enough rest, exercising regularly, and engaging in activities that help relieve stress. A well-rested and healthy trader is more likely to make rational decisions and maintain emotional equilibrium during trades.

In conclusion, emotional management is a critical component of successful trading. By recognizing emotional triggers, sticking to a trading plan, maintaining detachment, keeping a journal, setting realistic expectations, and practicing self-care, traders can enhance their ability to stay in control during trades. The journey to mastering trading psychology is ongoing, but with dedication and the right strategies, traders can learn to navigate the emotional landscape of the market and make decisions that are grounded in logic rather than emotion.

The Trader's Mindset: Developing Resilience and Emotional Discipline for Trading Success

Trading Psychology: How to Control Emotions During Trades

In the high-stakes world of trading, success is not solely a matter of technical knowledge or strategic acumen. The psychological aspect of trading plays a pivotal role in the decision-making process, often determining the difference between profit and loss. The trader's mindset, therefore, is a critical component of trading success, requiring the development of resilience and emotional discipline.

Emotional control in trading is akin to a tightrope walk, where balance is key. The market's volatility can trigger a spectrum of emotions, from the euphoria of a winning streak to the despair of a sudden loss. These emotional responses, if left unchecked, can lead to impulsive decisions, clouding judgment, and ultimately undermining a trader's strategy. It is essential, then, for traders to cultivate an ability to detach from these emotional highs and lows.

One effective method for managing emotions is to establish a trading plan with clear objectives and risk parameters. This plan acts as a roadmap, guiding traders through the tumultuous market landscape. By adhering to a well-thought-out plan, traders can reduce the temptation to make spur-of-the-moment decisions based on fear or greed. It is the discipline to stick to this plan, even in the face of market adversity, that often separates successful traders from those who struggle.

Another crucial aspect of trading psychology is the concept of mindfulness. Being mindful means maintaining an acute awareness of one's thoughts and emotions without being dominated by them. By practicing mindfulness, traders can observe their emotional reactions to market events without allowing these emotions to dictate their actions. This heightened state of awareness enables traders to respond to market changes with composure and rationality.

Moreover, resilience is an indispensable quality for any trader. The market is inherently unpredictable, and even the most seasoned traders will face losses. Resilience is the ability to recover quickly from setbacks, learn from mistakes, and continue trading without being paralyzed by fear of loss. Building resilience often involves a conscious effort to maintain a positive outlook and to view trading setbacks as opportunities for growth and learning.

To further enhance emotional discipline, traders can benefit from regular self-reflection. This involves reviewing trades to understand what went right or wrong and to identify any emotional patterns that may have influenced decision-making. By recognizing these patterns, traders can work on strategies to mitigate their impact in future trades.

Additionally, setting realistic expectations is vital for maintaining emotional equilibrium. Unrealistic goals can lead to excessive risk-taking and disappointment, which can fuel negative emotions. By setting achievable targets, traders can foster a sense of accomplishment and confidence, which can help in maintaining focus and emotional control.

In conclusion, the trader's mindset is a complex interplay of psychological factors that can significantly impact trading performance. Developing resilience and emotional discipline is not an overnight task but a continuous process that requires dedication and self-awareness. By establishing a solid trading plan, practicing mindfulness, building resilience, engaging in self-reflection, and setting realistic expectations, traders can learn to control their emotions, making them a powerful ally rather than a formidable foe in the quest for trading success. As traders master their emotions, they pave the way for a more disciplined, strategic approach to the markets, which is the cornerstone of long-term profitability and success.