“Master Your Mind, Master the Market: Conquer Emotional Biases for Peak Trading Performance”

Mastering Trading Psychology: Strategies to Combat Emotional Biases

Psychology of Trading: Overcoming Emotional Biases for Consistent Trading Success

In the realm of financial trading, success is often perceived as a direct result of one's ability to analyze markets, predict trends, and execute trades with precision. However, an often underestimated aspect of trading is the psychological component, which can be just as critical as the technical skills. The psychology of trading encompasses the emotional and mental states that influence decision-making, potentially leading to biases that can derail even the most well-thought-out trading strategies. Mastering trading psychology and developing strategies to combat emotional biases is essential for achieving consistent trading success.

One of the most common emotional biases that traders face is overconfidence. This bias can manifest after a series of successful trades, leading traders to believe they have a superior understanding of the market. Consequently, they may take on excessive risk, neglecting the fact that past performance is not indicative of future results. To counteract overconfidence, traders should adhere to a disciplined approach, setting strict risk management rules and sticking to them regardless of recent successes. This includes setting stop-loss orders to limit potential losses and taking profits at predetermined levels to avoid the temptation of holding on for even greater gains.

Another emotional bias that can impact trading decisions is loss aversion, the tendency to prefer avoiding losses rather than acquiring equivalent gains. This can result in holding onto losing positions for too long in the hope of a market reversal, or selling winning positions too early to lock in gains and avoid potential losses. To overcome loss aversion, traders should focus on the long-term perspective and the overall trading plan. It is crucial to accept that losses are a part of trading and that managing them effectively is key to long-term profitability.

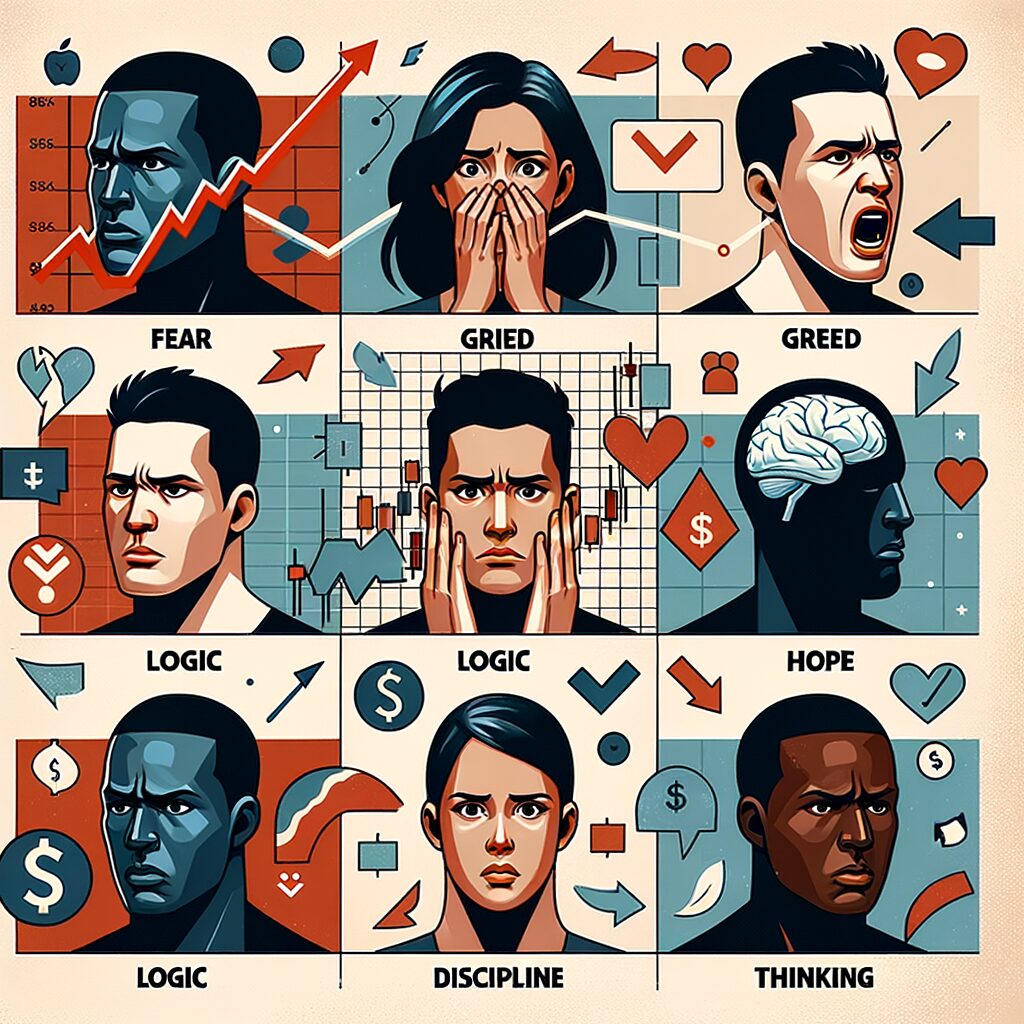

Fear and greed are two powerful emotions that can lead to irrational trading decisions. Fear can cause traders to exit positions prematurely or to avoid taking trades that align with their strategy, while greed can lead to chasing performance, overtrading, or staying in trades longer than warranted. To mitigate the effects of fear and greed, traders should cultivate emotional detachment by treating trading as a business. By focusing on the process rather than the outcomes and by maintaining a consistent approach, traders can reduce the influence of these emotions.

Confirmation bias is another psychological trap where traders seek out information that confirms their existing beliefs or predictions, while disregarding contradictory evidence. This can lead to a narrow view of the market and poor decision-making. To combat confirmation bias, traders should actively seek diverse perspectives and challenge their own assumptions. Utilizing a variety of analytical tools and considering alternative scenarios can help maintain objectivity.

Finally, the recency bias can skew a trader's perception, giving undue weight to recent events over historical data. This can lead to reactive trading based on short-term market fluctuations rather than a solid strategy. To avoid recency bias, traders should rely on a comprehensive analysis that includes both recent and long-term market trends.

In conclusion, while technical skills and market knowledge are indispensable for trading, the psychological aspect plays a pivotal role in achieving consistent success. By recognizing and addressing emotional biases, traders can develop a more disciplined and objective approach to the markets. Implementing strategies to combat overconfidence, loss aversion, fear, greed, confirmation bias, and recency bias can lead to better decision-making and improved trading performance. As traders become more adept at managing their emotions and psychological responses, they pave the way for a more stable and profitable trading career.

The Trader Mindset: Techniques for Achieving Emotional Neutrality in Markets

Psychology of Trading: Overcoming Emotional Biases for Consistent Trading Success

In the realm of financial markets, the trader's mindset is a critical determinant of success. Emotional biases can cloud judgment, leading to decisions that are not based on rational analysis but on fleeting feelings. Achieving emotional neutrality is essential for traders who aspire to make consistent profits and avoid the pitfalls of psychological traps.

The journey toward emotional neutrality begins with self-awareness. Traders must first recognize the emotional biases that influence their decision-making process. Common biases include the fear of missing out (FOMO), which can lead to impulsive trades, and loss aversion, where the fear of losses leads to holding onto losing positions for too long. By identifying these biases, traders can start to develop strategies to mitigate their impact.

One effective technique for achieving emotional neutrality is the practice of mindfulness. Mindfulness involves maintaining a moment-by-moment awareness of one's thoughts, feelings, and surrounding environment. By cultivating mindfulness, traders can observe their emotional responses without being controlled by them. This detachment allows for a more objective evaluation of the markets and prevents emotions from dictating trading actions.

Another strategy is to establish a well-defined trading plan. A trading plan should include entry and exit criteria, risk management rules, and a clear outline of the trader's investment goals. By adhering to a plan, traders can reduce the influence of emotions by ensuring that each trade is executed based on predefined criteria rather than emotional impulses. This disciplined approach helps to maintain consistency and rationality in the face of market volatility.

Moreover, the use of stop-loss orders is a practical tool for enforcing discipline. A stop-loss order is an order placed with a broker to buy or sell once the stock reaches a certain price. It is designed to limit an investor's loss on a security position. Setting these orders helps traders stick to their risk management rules and prevents the temptation to hold onto losing positions in the hope of a turnaround, which can exacerbate losses.

Journaling is another technique that can aid traders in achieving emotional neutrality. By keeping a record of their trades, thoughts, and emotions, traders can reflect on their decision-making processes and identify patterns in their behavior. This reflection can lead to better self-understanding and the development of strategies to counteract negative emotional tendencies.

Additionally, it is crucial for traders to maintain a balanced lifestyle. Trading can be a stressful endeavor, and it is easy to become consumed by the markets. Engaging in regular exercise, ensuring adequate rest, and pursuing interests outside of trading can help maintain emotional equilibrium. A balanced lifestyle contributes to a clear mind, which is better equipped to handle the psychological demands of trading.

In conclusion, the psychology of trading is a complex interplay between emotion and reason. To achieve consistent trading success, traders must strive for emotional neutrality by recognizing and overcoming emotional biases. Techniques such as mindfulness, adherence to a trading plan, the use of stop-loss orders, journaling, and maintaining a balanced lifestyle are invaluable in this pursuit. By mastering the art of emotional neutrality, traders can navigate the markets with a clear, focused mindset, making decisions that are grounded in analysis rather than swayed by emotion. The path to trading success is not just about financial acumen; it is equally about the psychological resilience to remain objective in the face of market turbulence.

Psychology Tips for Traders: Overcoming Common Emotional Biases for Better Decision Making

Psychology of Trading: Overcoming Emotional Biases for Consistent Trading Success

In the world of trading, success is often perceived as a direct result of one's ability to predict market movements and execute trades with precision. However, beneath the surface of this technical prowess lies a more subtle, yet equally critical, battleground – the trader's own psychology. The ability to overcome emotional biases is paramount for consistent trading success, as these biases can cloud judgment, leading to decisions that are less than optimal.

Emotional biases are deeply ingrained psychological tendencies that can skew the perception and reasoning of even the most seasoned traders. They often manifest as a result of our innate desire to avoid loss, seek pleasure, or simply adhere to a preconceived narrative about the market. One of the most common emotional biases is the fear of missing out (FOMO), which can compel traders to enter positions at inopportune times simply because they perceive others are profiting from a trend. Conversely, the fear of loss can lead to the premature closing of positions, leaving potential gains on the table.

Another significant emotional bias is overconfidence, which can arise from a string of successful trades. This can lead to an inflated sense of one's predictive abilities and result in taking on excessive risk without due diligence. On the flip side, a series of losses can lead to a lack of confidence, causing traders to second-guess their strategies and miss out on valid opportunities.

To overcome these emotional biases, traders must first acknowledge their existence. Self-awareness is the foundation upon which rational decision-making is built. By recognizing the emotional triggers that lead to biased thinking, traders can begin to develop strategies to counteract them. One effective method is to establish a trading plan with clear rules for entry, exit, and risk management. This plan should be based on thorough analysis and sound trading principles, not on the whims of emotion.

Moreover, it is crucial to maintain discipline and adhere to the trading plan. Discipline ensures that traders do not deviate from their strategy in the heat of the moment when emotions are most likely to take over. It acts as a safeguard against impulsive decisions that are not backed by logic or evidence.

Another technique to mitigate the influence of emotional biases is to practice mindfulness and stress-reduction methods. Trading can be a high-pressure activity, and stress can exacerbate emotional responses. By engaging in mindfulness practices, traders can cultivate a state of calm and clarity, enabling them to approach trading decisions with a level head.

Additionally, keeping a trading journal can be an invaluable tool for overcoming emotional biases. By documenting trades and the thought processes behind them, traders can reflect on their decisions and identify patterns in their behavior that may indicate the presence of emotional biases. This retrospective analysis can inform future trades and help traders refine their strategies.

In conclusion, while the technical aspects of trading are undoubtedly important, the psychological component cannot be overlooked. Emotional biases can lead to inconsistent results and undermine the potential for long-term success. By recognizing and addressing these biases through self-awareness, discipline, mindfulness, and reflective practices, traders can enhance their decision-making processes. Ultimately, the journey to consistent trading success is not just about mastering the markets, but also about mastering oneself.

The Role of Trading Psychology in Pursuing Consistent Trading Success

Psychology of Trading: Overcoming Emotional Biases for Consistent Trading Success

In the pursuit of consistent trading success, the role of trading psychology cannot be overstated. The financial markets are arenas where human emotions and cognitive biases are laid bare, often leading to decisions that deviate from rationality. Understanding and overcoming these emotional biases is crucial for traders aiming to achieve and maintain profitability over the long term.

The financial markets are inherently volatile, and this volatility can trigger a range of emotions in traders, from elation during a winning streak to despair during a downturn. These emotions, if left unchecked, can lead to impulsive decisions, such as chasing losses or deviating from a well-thought-out trading plan. The key to success lies in recognizing these emotional responses and developing strategies to mitigate their impact.

One of the most common emotional biases that traders face is overconfidence. After a series of successful trades, a trader may become overly confident in their abilities, leading them to take on excessive risk or ignore warning signs that they would have heeded under normal circumstances. This overconfidence can be tempered by maintaining a humble approach to the markets, acknowledging that no one can predict market movements with absolute certainty and that risk management is an essential component of any trading strategy.

Another emotional bias that often plagues traders is the fear of missing out (FOMO). When the markets are moving rapidly, and others appear to be making substantial gains, the fear of being left behind can be overwhelming. This fear can push traders to make hasty entries into trades without proper analysis or consideration of the risks involved. To combat FOMO, traders should focus on their individual trading goals and strategies, rather than being swayed by the actions or successes of others.

Loss aversion is another psychological hurdle that traders must overcome. The pain of a loss can be so intense that it leads traders to hold onto losing positions in the hope of a turnaround, or to exit winning positions too early to lock in gains and avoid potential losses. This bias can be addressed by establishing clear exit strategies for both winning and losing trades before entering a position, thus removing the emotional decision-making process from the equation.

Moreover, the tendency to anchor to specific price levels can also hinder trading performance. Traders may become fixated on the price at which they bought an asset, unwilling to sell for a loss even when market conditions suggest that it would be the prudent choice. Overcoming this bias requires a focus on current market data and trends, rather than past prices, to inform trading decisions.

To achieve consistent trading success, it is imperative for traders to cultivate emotional discipline. This involves developing a trading plan that includes not only entry and exit strategies but also rules for money management and risk tolerance. Adhering to this plan can help traders maintain focus and avoid emotional reactions to market fluctuations.

In addition, continuous education and self-reflection are vital. By studying market patterns and their own trading history, traders can identify instances where emotional biases may have influenced their decisions and work to prevent similar situations in the future.

In conclusion, the psychology of trading is a critical factor in the quest for consistent trading success. By recognizing and addressing emotional biases, traders can make more rational, disciplined decisions that align with their long-term objectives. It is through this mastery of the psychological aspects of trading that one can hope to navigate the tumultuous waters of the financial markets with confidence and poise.